Credit notes and refunds, what's the difference? Not a lot really, in Onyx they're pretty much the same thing, it's just that a credit note is still marked as owing to the customer (i.e. you haven't given them any money back) whereas a refund is marked as paid.

Because of the above we'll call credit notes and refunds by one name, refunds.

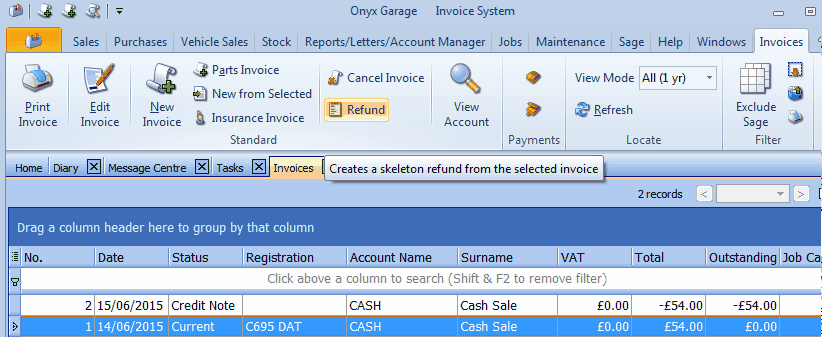

You can create a refund by either selecting the original invoice and then pressing 'Refund' on the 'Invoices' tab (Sales->View/Pay Invoices)

When you select an existing invoice to refund, Onyx does all the work for you, all you need to do is save the new document.

Alternatively, you can create a new refund directly by pressing 'Refund' from the 'Sales' tab

Onyx will now create a new unsaved document, it looks and works the same as when creating a normal sales invoice except that the document type will say 'Refund' (note, the below image shows a parts refund)

Select the customer as you would normally and then move to 'Document Details'

Notice how everything still looks the same as when creating a standard invoice except when you enter a new part the 'Row Total' field shows a negative amount. Onyx does this for you, you DO NOT have to enter a negative value. For example, below we've refunded an oil filter, notice that the 'Retail Price' (red rectangle) is still a positive value, but the 'Row Total' (yellow rectangle) is negative.

And when we accept the part and save the refund

We now have a new credit note. If we now make a payment to the customer to actually refund them (notice the negative payment amount)

Now that the refund is paid, it is marked as a refund in the list screen

Please note, you can change the name of 'Refund' and 'Credit Note' in the Options screen as below

You can also use Payment Allocations to use a Credit Note to pay a sales invoice

|